Managing personal finances is crucial in today’s fast-paced and ever-changing world. One of the most important concepts in financial planning, yet often misunderstood, is annual gross income. Many Filipinos struggle to fully grasp its significance when making financial decisions, which can impact their long-term financial stability. Understanding how much money you earn before taxes and deductions allows you to make more informed choices about budgeting, saving, investing, and planning for the future. This guide aims to simplify the topic of annual gross income, helping you understand its true value and how it can play a pivotal role in transforming the way you approach your financial planning and goals.

What is Annual Gross Income?

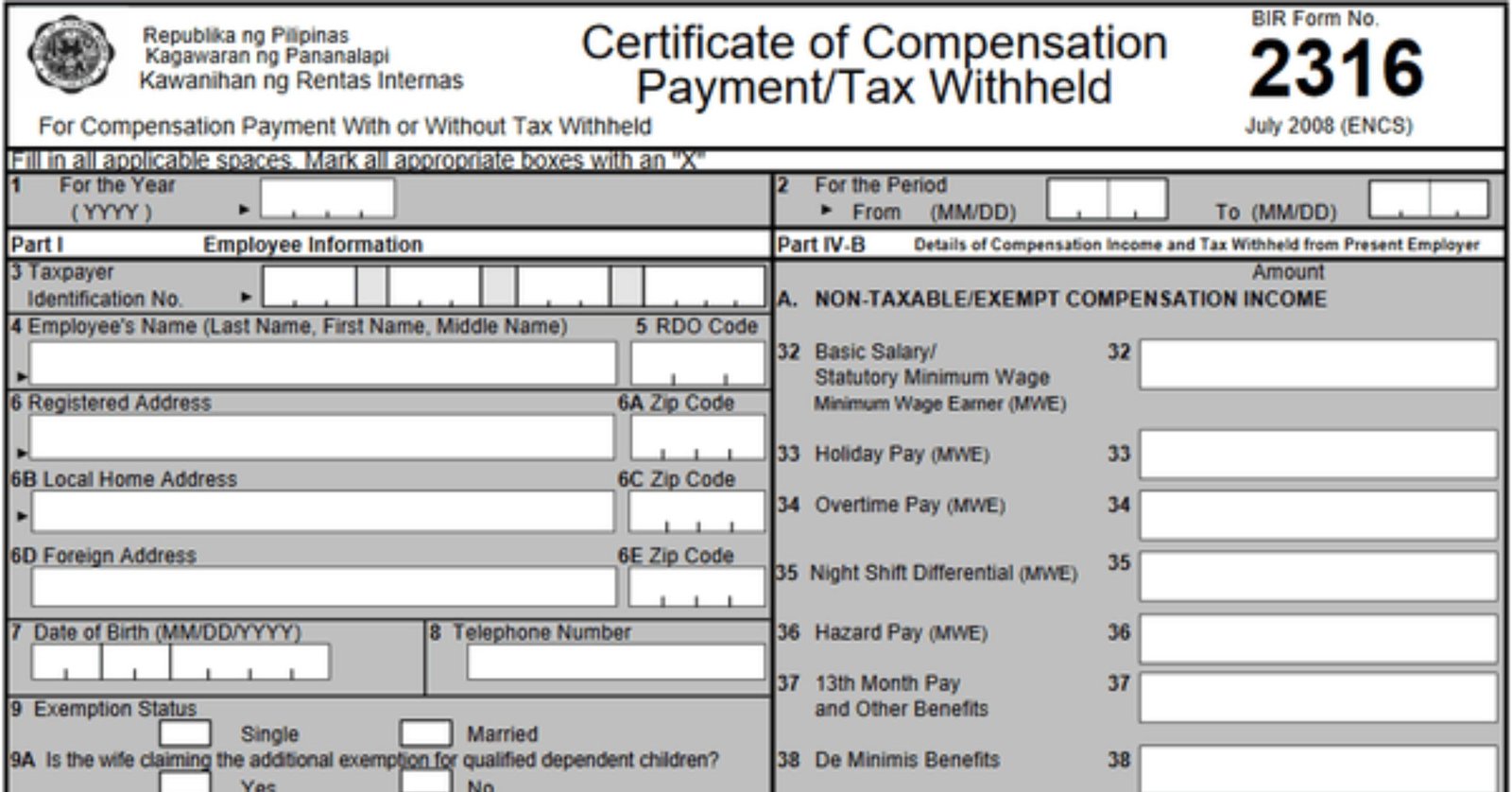

Gross income refers to the total earnings you make in a year before deductions. It includes your salary, bonuses, and other sources like freelance gigs or investments. In the Philippines, knowing your gross income is crucial for tax filing and budget planning.

Unlike net income, gross income doesn’t consider taxes or mandatory deductions like SSS, PhilHealth, and Pag-IBIG contributions. It provides a clear picture of your earning potential and serves as a basis for setting financial goals.

How to Compute Annual Gross Income

Calculating your gross income is straightforward. Start by determining your monthly salary. Multiply it by 12 months to get your yearly total. Add bonuses, commissions, or extra income sources.

For example:

Monthly salary: ₱25,000

Bonuses: ₱50,000 annually

Freelance work: ₱10,000

Annual Gross Income =(₱25,000*12)+₱50,000+₱10,000=₱360,000

This figure helps you gauge your financial health and make better plans for savings and investments.

Why Knowing Your Gross Income Matters

Understanding your gross income offers several benefits:

- Tax Planning: Avoid penalties by ensuring accurate tax returns.

- Budgeting: Allocate funds effectively to meet needs and save.

- Loan Applications: Present a clear income statement when applying for loans or credit cards.

Key Takeaways

Understanding annual gross income empowers you to manage your finances better. By computing your gross income accurately, you can plan taxes, budgets, and investments more efficiently. For Filipinos, this knowledge is a game-changer in achieving financial stability.